How to file taxes

Filing taxes is something that every United States citizen with a job has to do every three months. When you file taxes you can get the money back that your employers withheld on your paychecks. There are two types of tax returns to file, federal taxes and state taxes. This guide walks you through how to file federal taxes. In order to file taxes there are a few steps to take so that the taxes are filed effectively. I filed taxes over spring break for the first time, and it was not easy to do, even though some of the questions on the form are self explanatory, you need a little bit of help understanding the forms if it is your first time filing taxes. I had help from my parents which made it a little bit easier because they were available for any questions I had.

- Research how to file taxes. Before you file taxes for the first time it is important to research how to file them, so you are prepared to file the taxes and you know which method you want to use to file them. When you file taxes online (efile), or you can mail in the tax form. When I filed my taxes last week I mailed them in, so this guide will talk about how to file taxes by paper.

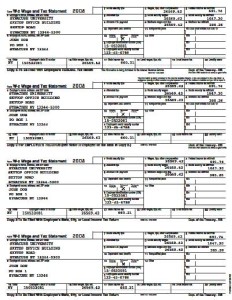

- Collect the W-2 forms. This is probably the most important step in filing taxes. You cannot file taxes until you have your W-2’s, because they tell you how much you have made from your job the previous year, as well as how much money was withheld form your paychecks. The money that was withheld on your paychecks is how much money you can get back as a refund on your tax return.This step can go along with the research step. I got myW-2’s before I researched how to file the taxes. I researched how to file taxes by googling how to file taxes. I did not spend a lot of time researching, which was not a smart move because even though the form was self explanatory researching and understanding why you needed to file taxes would have helped me out a lot. The picture on the bottom left is a sample W-2 form.

- Fill out the 1040 EZ. The 1040 EZ is the form you use to file federal taxes. You can find the form through either the irs website, www.irs.gov, or you can find the form at the library. While you are filling out the form you also will want to have the instructions to the form on your computer, or print them out with the form because they have some tables that you will need to reference while you are filling out your form. The picture on the bottom right is a sample 1040EZ form. If it is your first time filing taxes, you should probably get two copies of the form, so one is a rough draft, so the copy you send in is flawless.

- Mail the form in. If you owe the irs any money you need to attach the check or money order along with the payment voucher form you also need to fill out called the 1040V. Along with all of that you also need to attach all of the W-2 forms you have collected.